FREQUENTLY ASKED QUESTIONS

First implemented in 2006, the solar Investment Tax Credit (ITC) is a 30% federal tax credit for residential, commercial and utility scale solar systems placed in service prior to 1/1/2020. The credit is a dollar for dollar reduction in the income taxes of the customer claiming the ITC, worth 30% of the basis invested.

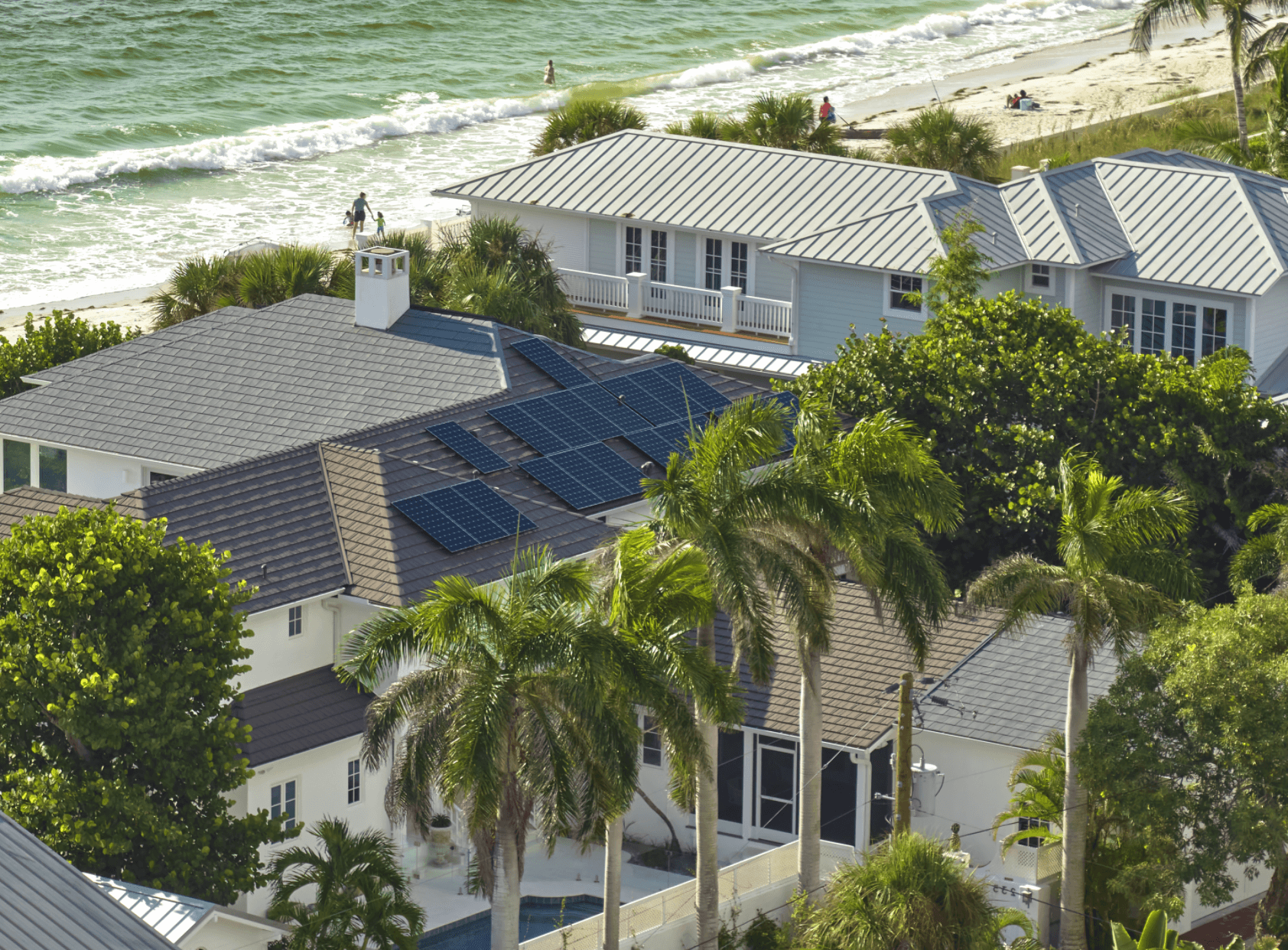

Net Metering enables residential customers who generate their own electricity to pump excess electricity back to the utility’s power grid. All electricity not used by the home and sent back to the grid is credited at a 1-1 retail rate. The utility effectively becomes a built-in battery for the solar system.

Unless your solar energy system is outfitted with battery storage and you are completely off the grid you will still receive a bill from the utility. That being said, you can reduce your bill significantly or even lower the total amount to $0 when the solar system produces as much electricity as your house consumes.

The amount of solar power your system generates depends on the level of sunlight it is exposed to. Thus, your solar panels will produce slightly less power on a cloudy day than a sunny day and no energy at night time. Our solar designers utilize a sophisticated program that looks at 50 plus years of weather data to determine the estimated average amount of solar a homeowner can expect in a year.

All of our systems are connected to the grid, if the grid is down then your solar system will shut off. Your system is shut off to prevent it from sending electricity to the grid where utility workers could be injured by the electricity

Find Out How MUCH You Could Save a Month ON YOUR ENERGY BILL